Want to know when you can start taking Social Security?

When can I start taking Social Security payments is a common concern for folks. Here’s our suggestion for the right age and how to get the most money. Start your journey to financial independence by getting rid of any credit card debt with the free, 7-Step Credit Card Debt Slasher.

Start taking social security at the right time

Did you know that Social Security only replaces about 40% of your pre-retirement income? And for many LGBTQ seniors, that’s not enough to live on. The good news is, it’s easy to find out how much you’ll get from Social Security and plan accordingly so that you’re financially secure in retirement.

So, when are you eligible to start collecting Social Security benefits? Should you start taking Social Security as soon as you can? Or is there an advantage to waiting?

On this episode of Queer Money, we discuss the 10-year age range when you’re eligible to start collecting Social Security and explain why you get less if you begin before ‘full retirement age’ or FRA. We walk you through examples of how much we will receive from Social Security if we start collecting benefits at age 62, 67 or 72, weighing in on the pros and cons of starting before you’ve reached FRA.

Listen in for the eight factors to consider as you decide when to take Social Security and learn how to develop multiple sources of income to support you in retirement!

Listen to find the best time for you to start taking social security

Topics Covered

- The 10-year range from age 62 to 72 when you can start taking Social Security

- How to determine your ‘full retirement age’ or FRA

- Why you get less if you start taking Social Security before your FRA (and more if you wait until after)

- How much our checks will be if we take Social Security at age 62, 67 or 72

- Why Social Security only replaces 40% of your pre-retirement income

- The pros and cons of taking Social Security before you reach FRA

- 8 factors to consider in deciding when to start taking Social Security

- Why you should have multiple sources of income to support you in retirement

Our examples of when we can take Social Security from SSA.gov/MyAccount

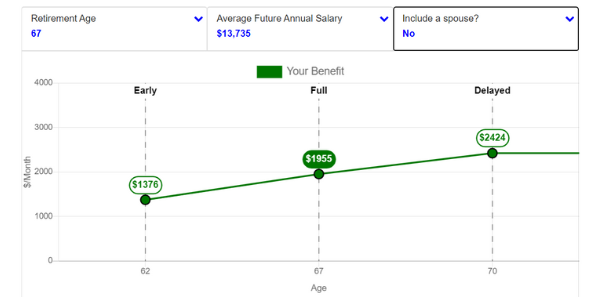

Here’s David’s chart:

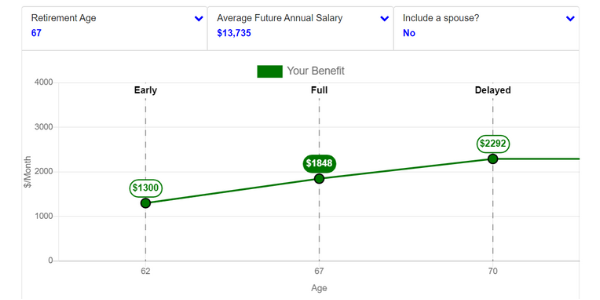

Here’s John’s chart:

Previous 3 Podcast Episodes

- The LGBTQ Money Study with The Motley Fool

- What Is Financial Self-Advocacy?

- Why LGBT Folks Should Become Trades Workers

Resources

- 2022 Huge Same-Sex Social Security Change on Queer Money® EP314

- Find Your Full Retirement Age

- My Social Security Account

- 7 Basics You Should Know About Annuities on Queer Money® EP298

- How to Know If You Should Buy an Annuity on Queer Money® EP307

- Gainbridge Education Center

- CreditWise

Connect with David and John

- Debt Free Guys on Youtube

- Queer Money Facebook Group

- Queer Money on Instagram

- Subscribe on iTunes

- Email [email protected]

We’re David and John Auten-Schneider, the Debt Free Guys (www.debtfreeguys.com) and hosts of the Queer Money® podcast. We help queer people (and allies) live fabulously not fabulously broke by helping them 1) pay off credit card debt, 2) become part- or full-time entrepreneurs and 3) save and invest for retirement.